Hyperliquid (HYPE): Bringing a Centralized Experience to Decentralized Trading | Deep Dive

Aiming to Deliver the On-Chain Innovation the Financial Industry Has Missed in the 21st Century

Intro

The chances are if you were anticipating the HYPE token airdrop, you were sitting at the keyboard, ready to claim and sell it immediately and collect some free profits before the token price reverted down.

Many people did this, but the price didn’t go down (and still hasn't). The token didn't do what most tokens do after an initial community distribution.

I thought it would be a good time to get some thoughts together around the trading landscape in crypto and break down what makes Hyperliquid different, technically and fundamentally. This post is a bit longer, but it was worth the process.

Hyperliquid is a decentralized cryptocurrency exchange established in 2023, which currently supports 100+ coins and trading pairs. But let me first set this up with some basics around the exchange market to explain more about Hyperliquid.

This is what we’ll cover:

Overview of CEXs and DEXs

Perp-DEXs

Market Making and Order Books

Hyperliquid Layer 1

Revenue Generation and Comparative Valuation

Growth Trajectory

Market Opportunities

Community Distribution

Funding and Support

PRODUCT & MARKET

▶️ Overview of CEXs and DEXs

In crypto trading, users face a key tradeoff: relinquishing custody of assets to trade on centralized exchanges (CEXs) or exposing their on-chain strategies by using decentralized exchanges (DEXs). CEXs, controlled by centralized institutions akin to banks, offer fiat-crypto trading pairs and customer support but require users to trust the platform with their funds, as highlighted by high-profile failures like FTX.

Conversely, DEXs operate on smart contracts, enabling trustless and anonymous transactions without lengthy KYC processes. However, DEXs only support crypto-to-crypto pairs, lack customer support, and expose all orders publicly on the blockchain, potentially compromising a trader’s competitive edge. Despite these challenges, and the drawdown of transparency, many traders prefer DEXs to retain custody of their assets.

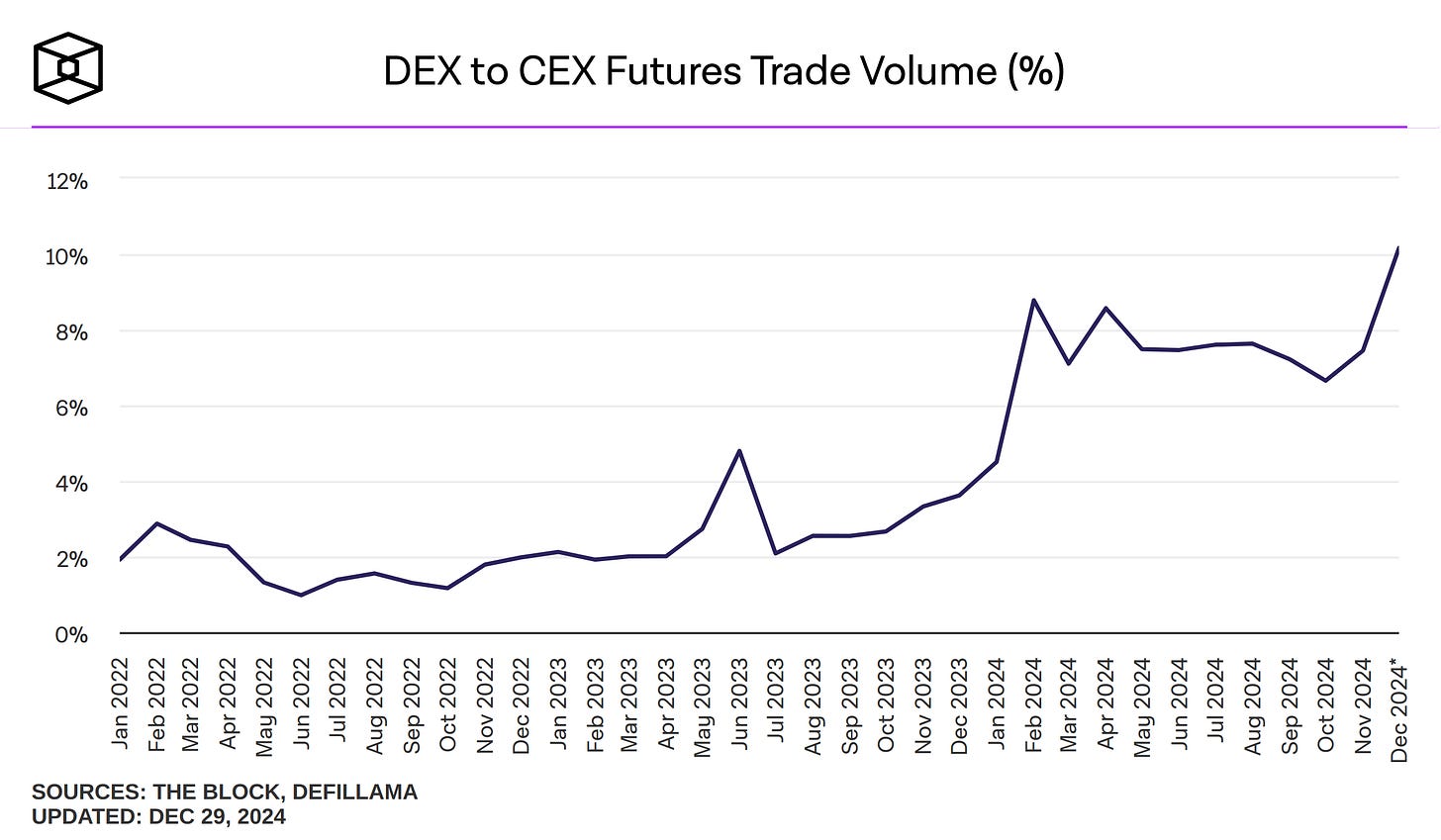

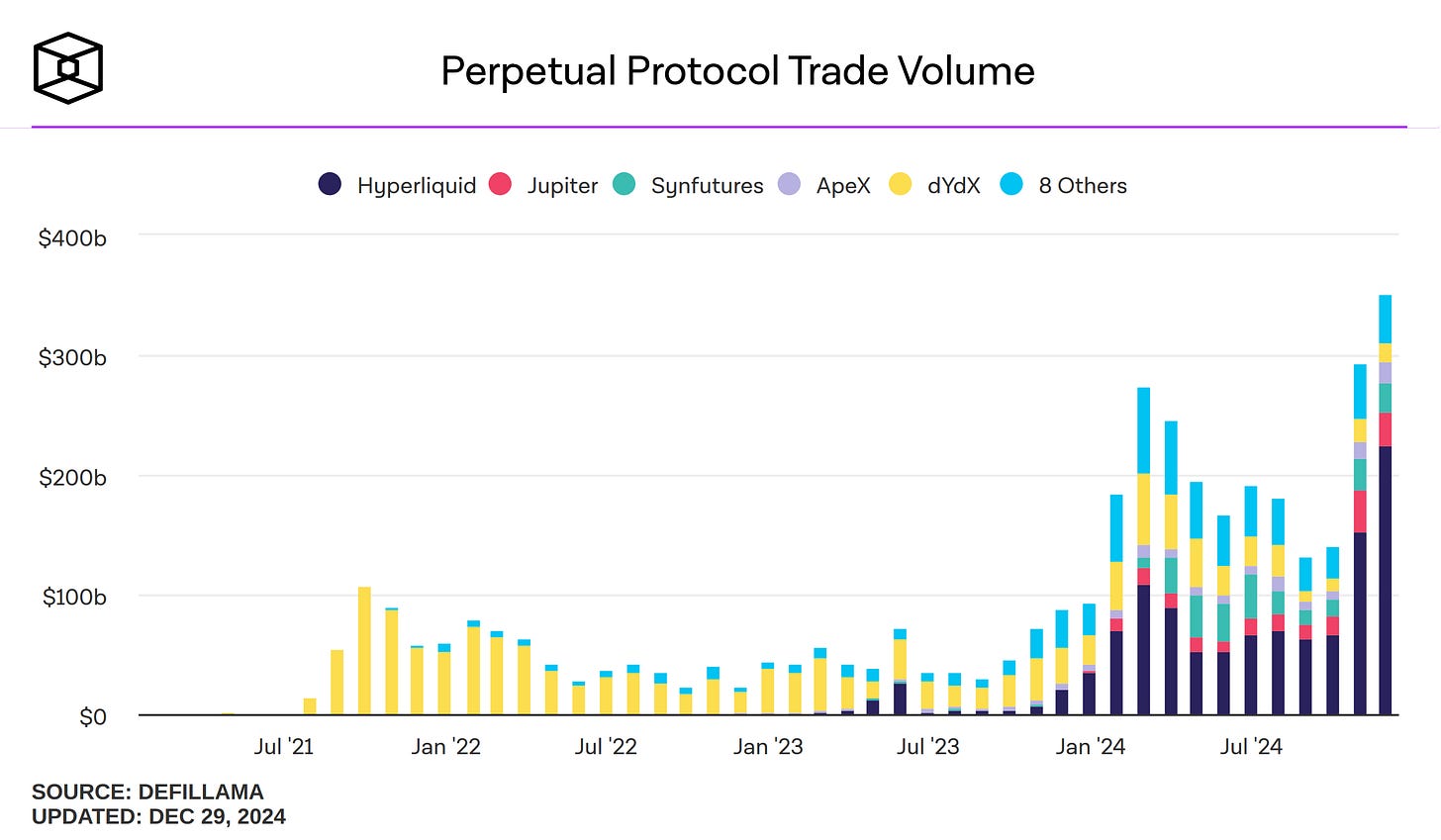

While decentralized exchanges (DEXs) are abundant, only a small portion offer perpetual contracts. However, these perpetual-DEXs dominate, accounting for 90% of DEX daily volume, approximately $350 billion today.

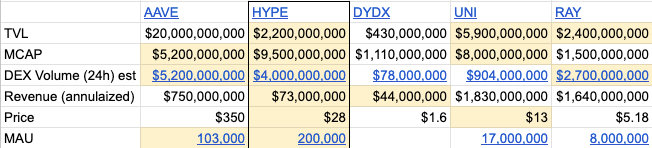

Here is a breakdown of the exchange market, and how Hyperliquid is currently stacking up;

251 Centralized spot exchanges - Based on daily trading volume (of ±$4 billion), Hyperliquid is competing with the top 15 exchanges (like Bitget, Coinbase, MEXC, and OKX)

105 Centralized derivative exchanges - Hyperliquid is facilitating more daily volume than half of these exchanges, and based on open interest Hyperliquid is competing with the the top 25.

393 Decentralized spot exchanges - With a daily volume of ±$4 billion, Hyperliquid is more than 2x that of Raydium and Uniswap, and is the 5th largest in terms of generating fees and in terms of TVL, which is at $1.75 billion.

18 Decentralized derivative exchanges - Hyperlquid already has 67% of this market (dYdX currently has 3%).

To put this into perspective, Hyperliquid launched in mid-2023, seeing explosive growth in volume in the last quarter of 2024.

If you enjoy or get value from Financial Badvice, please;

Forward this email to friends and tell them to subscribe,

Share on LinkedIn, Twitter, and Facebook with a short note,

Share within your existing community or company Slacks.

▶️ Perp-DEXs

Exchanges are among the most profitable businesses in crypto. Centralized perp exchanges have dominated through the years. Since BitMEX pioneered the perpetual future in 2016, exchanges like Binance and FTX added them to their arsenal, capturing hundreds of billions in daily volume. Centralized exchanges still dominate crypto trading, dwarfing decentralized exchanges in terms of volume.

Perpetual contracts are popular derivatives in crypto, allowing traders to buy synthetic exposure to financial assets and take leveraged positions without expiration dates (unlike futures). Compared to options, they involve higher risks but offer simpler liquidation management and lower trading costs, making them an attractive choice for many traders.

Unlike most blockchains that host DEXs, which were not designed with exchanges in mind, Hyperliquid’s Layer 1 (L1) blockchain was purpose-built to optimize high-frequency perpetual DEX trading. This design eliminates gas fees for trades (I’ll explain more on this), apart from actions like wallet transfers or spot listings, which impact state bloat. In contrast, other general-purpose blockchains supporting high-frequency trading must share block space with other transactions, increasing computational demand and costs. Hyperliquid’s blockchain prioritized DEX operations above any other function.

What is becoming clearer to me the more I read, is that Hyperliquid aims to become the foundational layer for all perpetual swap trades, combining transparency and accessibility with auditable on-chain operations. By reducing trust assumptions and avoiding insider advantages. Hyperliquid’s North Star is balancing the efficiency of centralized controls with the openness of decentralized systems.

▶️ Market Making and Order Books

Order books are fundamental to trading, displaying buy and sell orders with transactions occurring where these orders intersect. To ensure smooth trading, market makers provide liquidity, bridging gaps between buyers and sellers.

Traditional exchanges rely on professional traders or institutions for this role, whereas decentralized exchanges (DEXs) often use Automated Market Makers (AMMs). AMMs replace traditional order books with liquidity pools that automatically adjust token prices based on supply and demand.

In the AMM model, anyone with capital can become a liquidity provider by depositing tokens into liquidity pools for specific token pairs. This setup ensures continuous liquidity regardless of trade size, as traders transact directly with the pool rather than waiting for a counterparty. Liquidity providers earn a share of trading fees, typically around 0.3%, proportional to their contributions to the pool.

However, AMM-based liquidity provision carries risks, particularly impermanent loss, which occurs when deposited assets' prices fluctuate compared to their initial value. These losses can outweigh the rewards from trading fees and LP tokens if price changes are significant. While AMMs provide continuous liquidity, their passive strategies can be vulnerable to arbitrage exploitation by sophisticated traders.

Hyperliquid diverges from this model by acting as its own primary market maker, leveraging its balance sheet and expertise to actively manage liquidity. This approach uses USDC exclusively as collateral and deploys dynamic strategies to minimize risks like arbitrage. Hyperliquid’s infrastructure aims to offer a more efficient and adaptable alternative to traditional AMM systems, allowing users to deposit to HLP (Hyperliquid Provider vault that does the market making) and share in its revenue (usually reserved for large funds or market-making institutions).

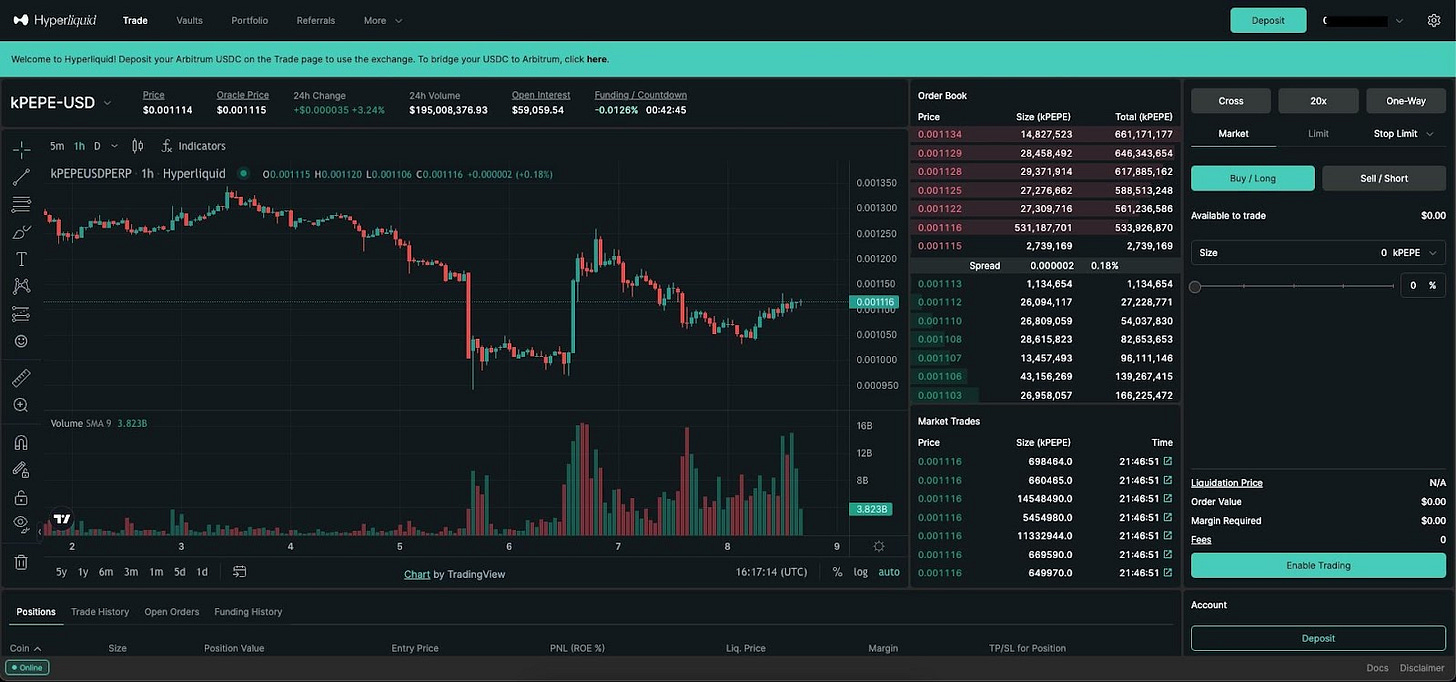

What truly sets Hyperliquid apart is its fully on-chain order book, a stark contrast to competitors like dYdX. This transparency lets users observe order flow and verify that trades follow strict rules. Such openness provides a significant advantage over centralized exchanges (CEXs), where hidden practices like frontrunning or order flow redirection can erode user trust. High-profile cases, such as allegations against Alameda Research and Robinhood, have underscored the importance of transparency in ensuring fairness and maintaining user confidence.

Hyperliquid’s on-chain order book not only enhances transparency but also positions the platform as a trust-first alternative in the evolving landscape of decentralized finance.

▶️ Hyperliquid Layer 1

Building an on-chain order book enhances transparency, integrability, and auditability but comes with challenges. It requires significant computational resources, increases block size, demands extensive validation, and can introduce latency issues. Hyperliquid addresses these concerns with its custom L1 blockchain, HypeBFT (Byzantine Fault Tolerance - consensus algorithm), designed to ensure high performance and competitive speeds (currently supporting 200K operations/second) tailored to the demands of perpetual decentralized exchange (DEX) trading.

Hyperliquid's architecture integrates two interconnected chains: the Hyperliquid Layer 1 (L1) and the HyperEVM. The L1, a high-performance permissioned chain, supports native components like perpetual and spot order books, with programmability enabled via an API requiring signed actions (however the exchange offers a CEX-like one-click trading experience). Meanwhile, the HyperEVM is an EVM-compatible, general-purpose chain that allows unrestricted smart contract deployment (read on for their innovative token standards) while accessing on-chain liquidity from the L1 for trading, creating a seamless and efficient ecosystem.

A crucial component of this system is the matching engine, which pairs buy and sell orders. While all margin and matching engine states are recorded on-chain, the engine itself operates off-chain and is run by validators. This approach minimizes block bloat and enhances speed but introduces a trade-off, as the DEX is not entirely transparent despite having an on-chain order book.

Understanding Hyperliquid's custom L1 requires distinguishing between the blockchain and its smart contracts. The order book resides in smart contracts, making it transparent and auditable. The blockchain is optimized to handle the computational demands of these smart contracts, ensuring smooth functionality even under heavy transaction loads.

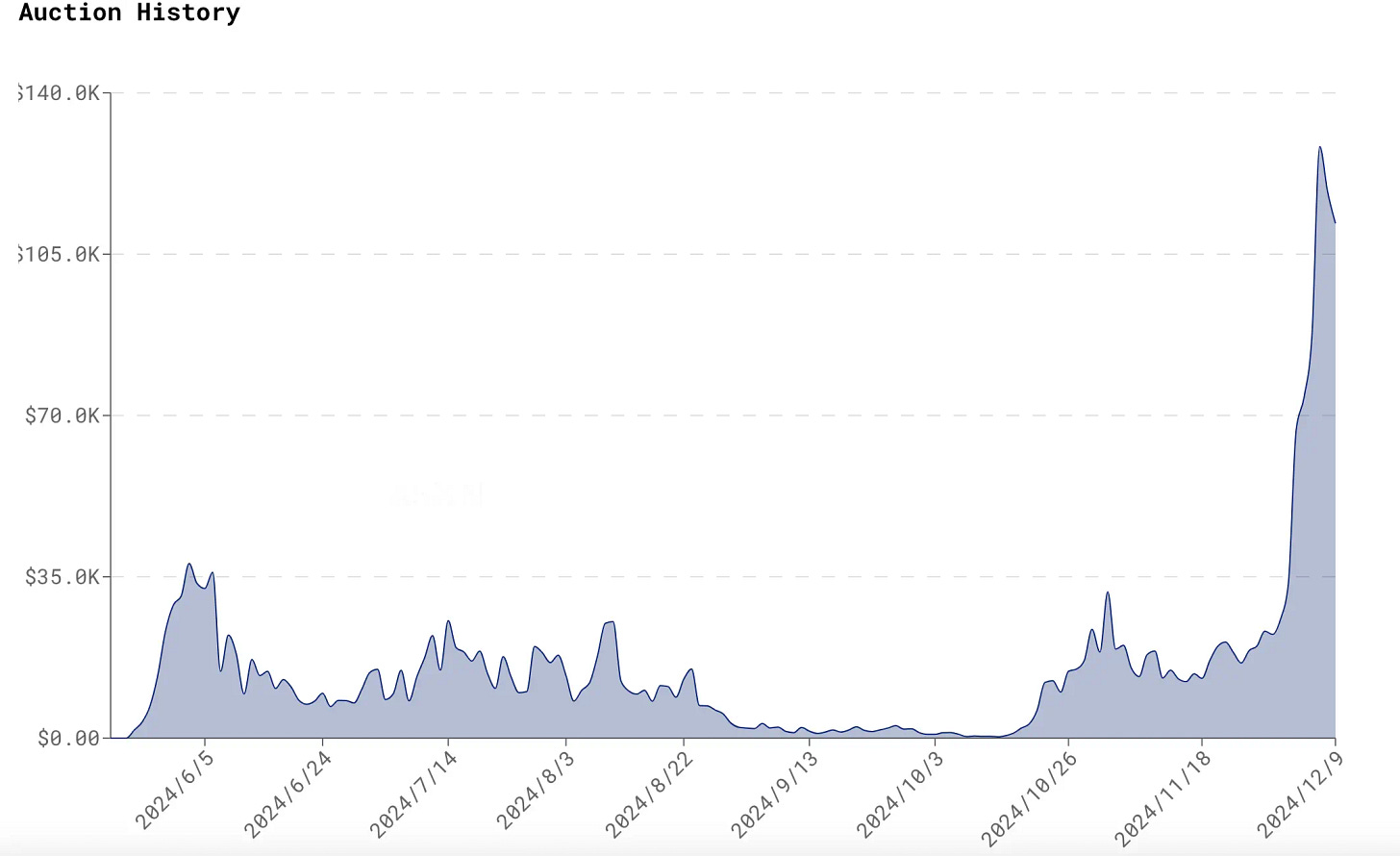

Hyperliquid’s L1 also includes a decentralized, Dutch auction, listing process which introduces innovative token standards, ‘HIP-1’ and ‘HIP-2’. These standards enhance transactional functionality and provide integrated liquidity at issuance. Unlike ERC-20 tokens, which rely on external platforms or liquidity providers, tokens built on Hyperliquid’s standards achieve instant tradability and utility, reducing dependency on third-party systems.

Currently, Hyperliquid relies on Arbitrum for on-chain deposits and withdrawals (which does require gas—for now), with over 60% of the USDC on Arbitrum held by Hyperliquid addresses. This partnership is mutually beneficial: Hyperliquid boosts Arbitrum’s activity and liquidity, while Arbitrum provides stable and cost-effective infrastructure until Hyperliquid’s main net launches.

But why build a custom L1 instead of relying entirely on Arbitrum, a robust Ethereum Layer-2 (L2) solution? While L2s are significant advancements over Ethereum mainnet, they are still costly for the high transaction volumes of an order book. For example, executing or canceling an order on Arbitrum can cost between $0.02 and $1.00, which significantly impacts market-making strategies. These strategies involve placing and canceling large volumes of orders, and high gas fees can disrupt their efficiency, widening spreads and ultimately disadvantaging retail users.

By building an L1, Hyperliquid will avoid these inefficiencies. The infrastructure keeps transaction costs low, even as demand and volume increase, allowing market makers to execute high-frequency strategies without prohibitive costs. This efficiency creates a reflexive loop: market makers can quote tighter spreads, attracting more users with lower trading costs, which further incentivizes market makers through higher volumes.

Hyperliquid’s ability to provide gasless trading, coupled with its market-making expertise and custom infrastructure, positions it as a strong contender to become the dominant trading venue in crypto. Its integrated approach offers a compelling alternative to both centralized exchanges and traditional DEXs, delivering efficiency, transparency, and cost advantages.

FINANCIALS & MARKET SHARE

▶️ Revenue Generation and Comparative Valuation

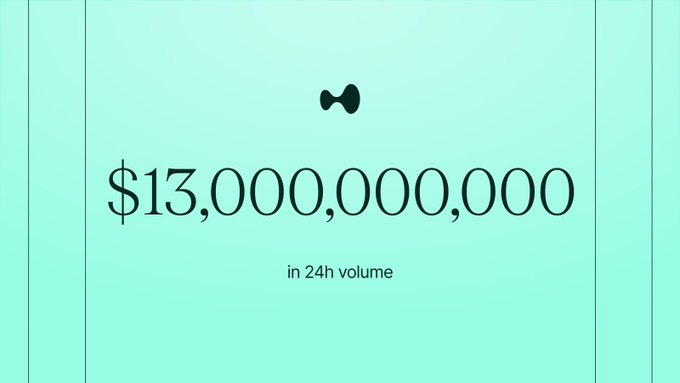

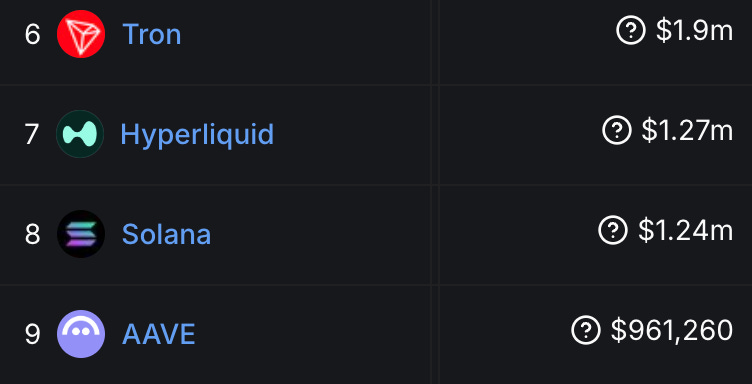

Hyperliquid has demonstrated remarkable revenue generation, exceeding $1 million per day in the past month. This positions the project ahead of prominent blockchains like AAVE and Solana in daily revenue metrics. Central to Hyperliquid's success is its quasi-app chain model, which allows token holders to accrue both chain-level and application-specific fees. This dual-incentive structure mirrors dYdX's model but distinguishes itself with a fully on-chain approach. In contrast, dYdX daily fees have averaged ±$200K in 2024, while AAVE (with 10x more TVL) daily fees have averaged ±$1 million in 2024.

Hyperliquid incentivizes HYPE token holders with reduced trading fees, encouraging long-term holding and ecosystem participation. Unlike competitors such as Drift, Vertex, AEVO, and Solana-based platforms that rely on hybrid or off-chain components, Hyperliquid integrates its order books entirely on-chain. This approach ensures greater transparency, decentralization, and user trust, setting it apart in a competitive market.

Revenue Structure

Hyperliquid’s business model generates revenue through three primary fee types:

Trading Fees: The fee model includes a flat 2.5 bps taker fee, which is competitive with high volume tier CEX fees, and a 0.2 bps maker rebate. Unlike other fee structures where only the highest volume traders get low fees, all traders on Hyperliquid have the same low taker fee. Referrers even receive 10% of their referees’ fees.

Congestion Fees: Charged when the network is nearing capacity, reflecting demand for block space (actions like wallet transfers or spot listings, which impact state bloat.)

Token Auction Fees: To secure the rights for new token issuance, projects participate in a Dutch auction held approximately every 31 hours, enabling up to 282 token codes to be deployed annually. The auction fee, akin to a deployment gas fee, is paid in USDC and decreases over the 31-hour period, starting from a higher initial price and dropping to a minimum of 10,000 USDC.

HYPE Token Burn Mechanism

A key component driving the potential price appreciation of the HYPE token is its burn mechanism. A portion of the fees generated through network activity is allocated to buy and burn HYPE tokens, reducing the total supply over time. This deflationary mechanism creates upward pressure on the token's value by increasing scarcity, especially as network activity grows.

For example, if daily trading volumes continue to rise, the corresponding increase in fees would result in larger token burns. This reflexive loop—where higher activity leads to greater fee generation, more token burns, and potentially higher token prices—acts as a reinforcing cycle benefiting both the ecosystem and HYPE holders.

Comparative Advantage and Opportunities

Hyperliquid’s fully on-chain model and efficient fee structure position it as a leader among decentralized exchanges. Unlike platforms like dYdX, which moved key components off-chain, Hyperliquid ensures transparency and aligns user incentives with ecosystem growth. Its ability to integrate chain-level and application-specific fee accruals, combined with the HYPE token’s deflationary mechanics, makes it a compelling choice for traders and token holders alike.

In comparison, Binance's market valuation stands at $62 billion, making it the leading crypto fintech in 2024. Bybit has a valuation estimated between $15 to $20 billion. Given Hyperliquid's current growth trajectory and user-friendly features, such as rapid account creation without the need for extensive KYC procedures, its valuation suggests significant potential for future expansion.

▶️ Growth Trajectory

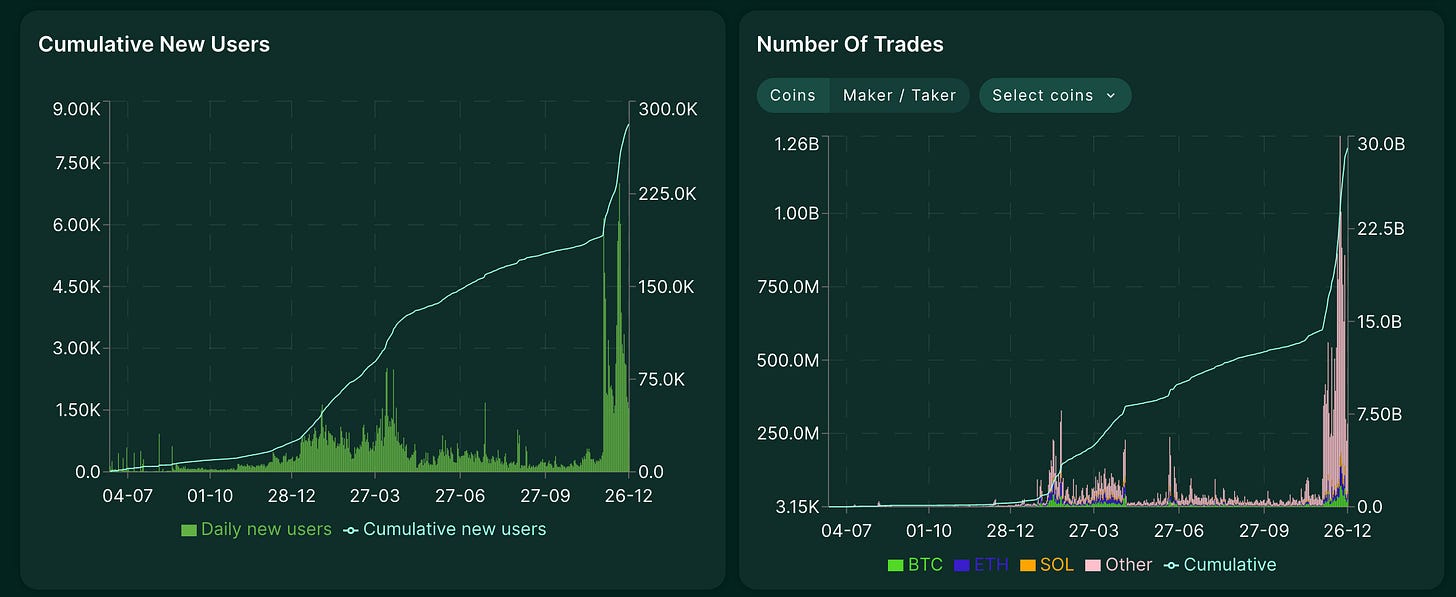

Despite there not being much publicity on social media around the points system or the subsequent mammoth airdrop (which I will discuss below), the result of the airdrop itself brought in a wave of over 10,000 new users 48 hours following the announcement, pushing up transaction volume more than 10x in November (from October). Despite this not having the same effect on trading volume, it was unique in that users typically drop off following a project’s airdrop.

The best marketing in crypto is the token price going up, and airdropping almost $10 million to users seemed to have set off a long wave of user acquisition for Hyperliquid. Do I think this will be the case for all bigger airdrops? No. This is a case of good tech meeting market demands, by an independent team with deep experience in the space for a strong community.

Hyperliquid's design prioritizes ease of use and seamless execution, making it accessible to both retail and institutional users. This focus on user experience could lower barriers to DeFi adoption. Additionally, Hyperliquid has cultivated a dedicated community of over 200,000 users, with an impressive cumulative trading volume nearing $450 billion.

Hyperliquid’s growth trajectory is strongly supported by its engaged and knowledgeable community. This community consists of two key groups: developers exploring the protocol to build new products and enthusiasts who critically analyze its architecture. The depth of technical discussions in Hyperliquid’s Discord reflects genuine interest and active utilization of the platform, fostering an environment of innovation and trust that is essential for long-term success.

▶️ Market Opportunities

The exchange UX/UI is optimized for a smooth trading experience. Despite the experience and onboarding being incredibly easy, Hyperliquid can be the dominant exchange for retail taking flow (this is their bet).

Secondly, they understood crypto market structures and how to build to the point where it is competitive (or on the path to compete) with centralized exchanges and is beginning to threaten the trading narrative from Solana (which has overwhelmingly become meme coins, leaving a void for other opportunities like Hyperliquid).

Third, most people are likely underpricing the probability of perpetual swaps being the dominant venue for retail to trade on (above options), partly due to the seamless onboarding process and mostly because of the simplicity. Implied volatility and convex products like options can be unnecessarily complicated making the risk of losing higher. There is more edge for trading firms to trade options against retail as opposed to trading perps against retail (because perps are linear).

If you gave retail the option of where to trade (option or perp) they would choose a perp almost every time. Retail wants to make $1 when a stock goes up and lose $1 when the stock goes down and multiply that by 100x if they want to.

The predominant export America has is its liquid standardized financial markets that are precedent-setting for the entire world and the dominant venues for capital market trading. In saying this, retail would most likely choose leveraged perpetual products with robust user liquidity and transparent order books to express free-market positioning, bypassing option fees.

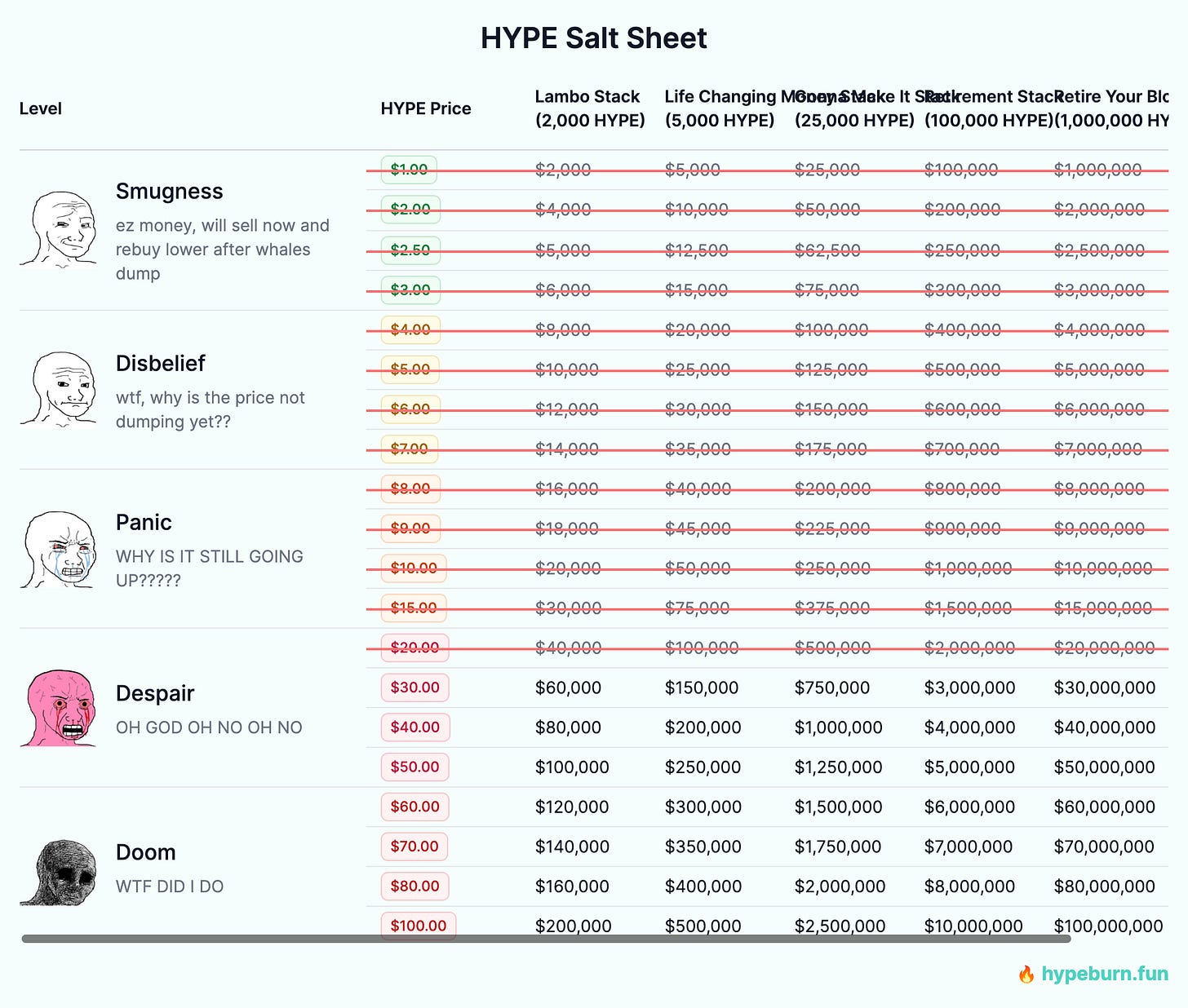

Lastly, retail investors have yet to enter the market significantly, as the HYPE token is not yet available on Tier 1 centralized exchanges, this could be a notable catalyst for its price.

LEADERSHIP & COMMUNITY DISTRIBUTION

▶️ Community Distribution

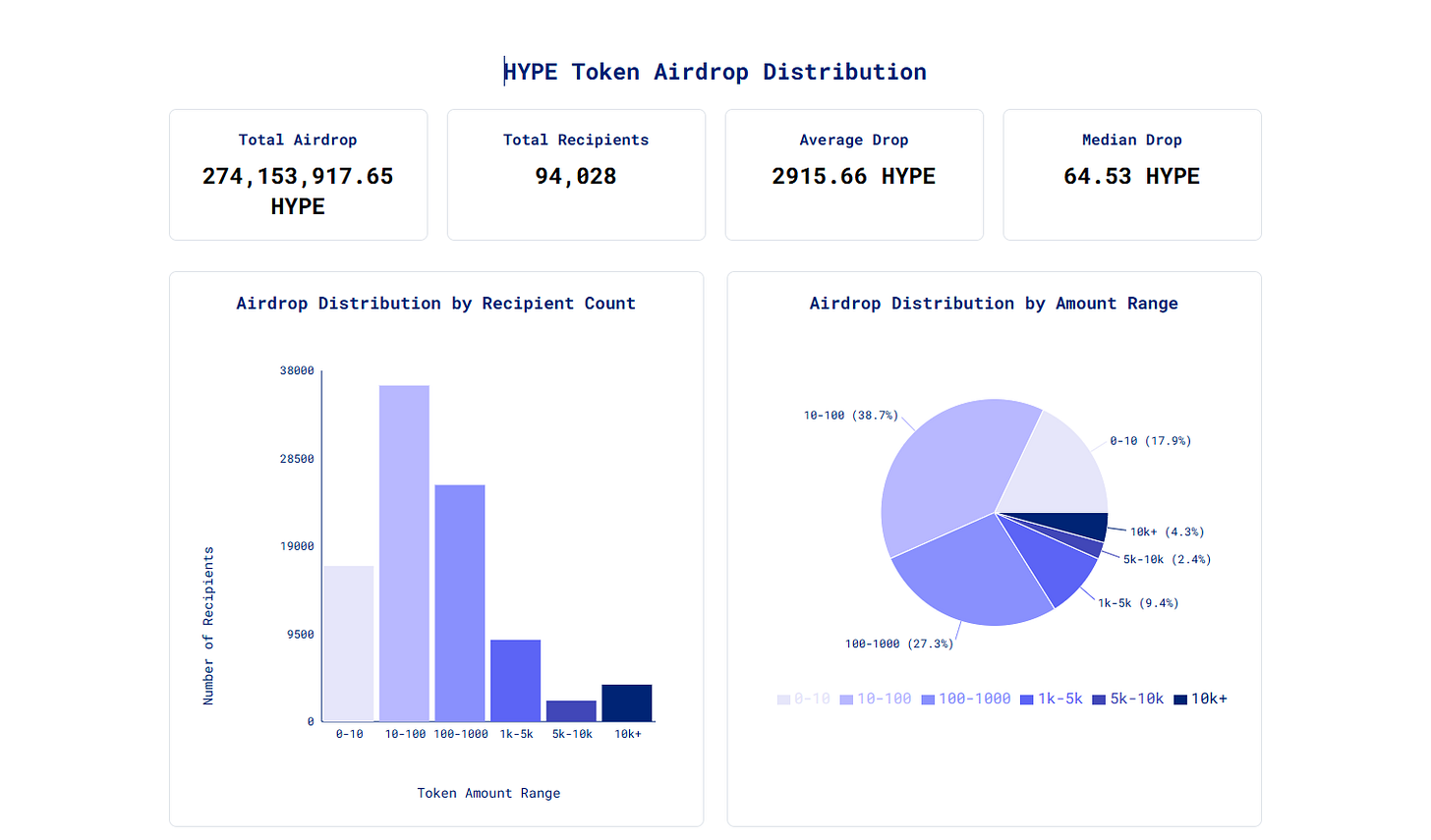

Hyperliquid set a new bar in terms of token distribution, and as of writing, the market value has peaked at over $9 billion, ranking HYPE around #20 among all tokens and on par with Uniswap (UNI). The average airdrop (as with all averages) is skewed upwards by the larger rewards. Overall, ±40% of users received between 10 and 100 tokens and ±20% received less than 10.

Hyperliquid has distinguished itself through a team-oriented approach and innovative strategy, avoiding the typical pitfalls of token launches. Unlike many founders who treat token creation as a personal liquidity event, Hyperliquid’s team—already financially successful—invested ±$100M into the token at launch. With no need to sell, the team focuses on maximizing network ownership and understanding the long-term value of exchange equity. This aligns with their goal to build sustainable growth rather than short-term profits.

In conjunction with the publicity of the airdrop, the lack of sell pressure on the token price brought in a wave of over 10,000 new users in 48 hours (now at almost 100,000 additional users since the airdrop), resulting in the token price surging nearly 5x in less than 3 days. Although the new users did not bring much change in trading volume, 310 million tokens at $2 a token puts the CAC at ±$6k, which is expected to reduce over time.

Hyperliquid’s launch strategy further reinforces its uniqueness. By avoiding public farming formulas for its token, it ensured that airdrop recipients were genuine platform users rather than opportunistic participants. In telling users what they should do, game theory dictates that people will do the bare minimum. By rewarding genuine users, Hyperliquid has set a standard for both users and protocols.

The absence of early venture overhang or seed-round sellers created a more stable token ecosystem. Post-airdrop, daily USDC bridging ranged between $50M-$150M, reflecting sustained user interest. Trading volume has grown by 50%, despite market volatility remaining steady, underscoring organic user engagement and loyalty.

▶️ Funding and Support

Hyperliquid is spearheaded by a team of former high-frequency traders who identified inefficiencies in current on-chain systems and sought to create a fully transparent, open-source alternative to centralized exchanges (CEXs), particularly in the wake of FTX's collapse. The team is led by Jeff and Iliensinc, who were both classmates at Harvard.

The CEO, Jeff Yan, brings a distinguished background. A Gold and Silver Medalist at the International Physics Olympiad (2013) and a Harvard graduate, Yan has worked with leading global trading firms. His experience as a high-frequency trader at Hudson River Trading informed his creation of Chameleon Trading in early 2020. Chameleon grew rapidly by capitalizing on inefficiencies in the crypto market, becoming one of the top 10 market makers by volume on Binance.

Yan transitioned to Hyperliquid full-time to leverage his expertise in traditional and crypto markets, aiming to rebuild and modernize the financial system. Unlike many other industries, finance has seen little meaningful innovation in the past two decades, still relying on legacy technologies. Hyperliquid’s vision reflects an ambition to address these gaps and bring transformative change to the financial landscape.

The other members of the team are from Caltech, MIT, and Waterloo. All of the team members have core financial and technical expertise having worked at companies in various domains.

Team Strength and Financial Independence

Hyperliquid’s team leverages deep market-making expertise to shape product milestones and its development roadmap. Their prior success as proprietary traders allows them to self-fund the project without the need for outside capital. Key advantages include:

Self-Market Making: The team uses its own capital to ensure deep liquidity on the Hyperliquid order book.

No Pressure to Sell Tokens: Unlike many founders who treat token creation as a liquidity event, Hyperliquid’s team purchased $100 million worth of their own tokens at launch, demonstrating long-term commitment.

Autonomy in Decision-Making: Without external investors, the team maintains the flexibility to focus on customer needs and long-term growth rather than short-term stakeholder interests.

A Unique Position to Innovate

Unlike typical crypto founders, Hyperliquid’s team possesses the capital, expertise, and freedom to innovate without constraints. This autonomy allows them to prioritize customer-centric solutions, develop a loyal user base, and adopt a long-term perspective on growth. Their understanding of both traditional and crypto market structures positions Hyperliquid as a strong competitor to centralized exchanges.

Housekeeping: If it appears that I have overlooked anything or any information is incorrect, please do get in touch. Happy to take feedback, discuss, rethink, and edit accordingly.

AJ